Let’s face it: managing money isn’t always easy, and most of us weren’t taught how to do it growing up. But here’s the good news—you can take control of your finances, and it’s not about being rich or having a finance degree. It starts with simple, smart habits that anyone can follow

This guide breaks down 10 essential money rules, why they matter, and exactly what you can do to stick to them and thrive financially. Whether you’re saving for your first home, climbing out of debt, or just trying to stop feeling broke every month, these rules will help you build a stronger financial foundation.

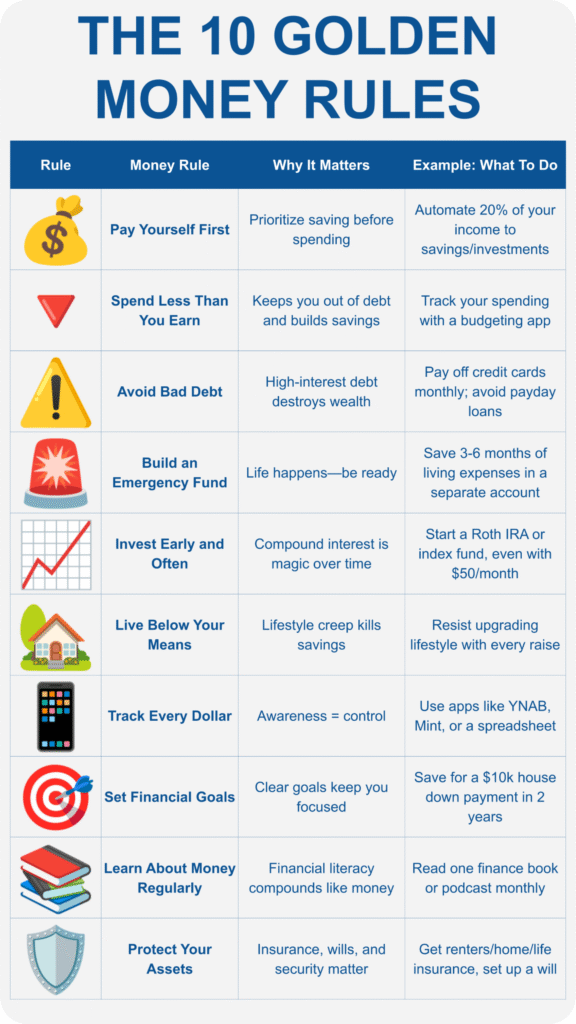

Quick Look: The 10 Money Rules

1. Pay Yourself First

What it means: Save before you spend—not after.

When money hits your account, the first thing you do isn’t paying bills, shopping, or dining out. It’s saving.

You treat saving and investing as your #1 priority—not an afterthought. Think of saving like a non-negotiable bill you owe to yourself.

The golden rule: You work hard for your money. Make sure your money works for you too.

Why its so powerful:

Most people try to save “whatever’s left over” at the end of the month. (Spoiler: usually, nothing is left.)

By flipping the order and saving first, you guarantee you’re building wealth—every single month.

This small shift in habit separates the people who struggle forever from those who build real freedom over time.

How to do it step by step:

✅ 1. Calculate a savings rate you can stick to — Aim for 15–20% of your take-home pay.

✅ 2. Set up automatic transfers — As soon as your paycheck clears, have your bank automatically move money into:

- A high-yield savings account (for short-term goals/emergencies)

- Retirement accounts like a 401(k), Roth IRA

- Investment accounts (for long-term growth)

✅ 3. Make it invisible — The goal is to make saving so automatic that you forget the money ever existed in your spending account.

✅ 4. Start small if needed — Can’t do 20% today? No problem. Start with 5% and increase by 1% each month.

✅ 5. Treat savings like a bill — Just like you wouldn’t skip rent or electricity, don’t skip your savings “payment.”

- Set up automatic transfers the day you get paid.

- Direct 15-20% of your income into savings or investment accounts (401(k), IRA, etc.).

Real-world Example: If you earn $3,000 a month, set up an auto-transfer of $600 (20%) to your savings and investment accounts before touching the rest:

- $300 to a Roth IRA

- $200 to a high-yield savings account

- $100 to a brokerage account (investing)

Now, you can spend the remaining $2,400 freely—without guilt—knowing you’ve already handled your future!

2. Spend Less Than You Earn

What it means: You must spend less than you make, always.

You must live below your means. That means spending less than your income — every single month — so you can build savings, invest, and avoid debt.

This is the foundation of all financial stability. Even if you earn a lot, if you spend it all (or more), you’ll never get ahead.

Why it matters:

Many people confuse high income with financial success. But if you earn $10,000/month and spend $10,001, you’re worse off than someone earning $3,000 who spends $2,500.

Wealth isn’t about how much you make—it’s about how much you keep.

How to do it:

1. Know Your Net Income

Calculate your take-home pay after taxes, benefits, and deductions. This is what you actually have to work with.

Example:

Gross pay: $5,000

Taxes & deductions: $1,000

Net pay: $4,000

2. Set a Spending Cap

Aim to spend no more than 80% of your net income.

If your take-home pay is $4,000, your monthly spending target is $3,200 or less.

That extra 20%? It should go straight to savings, investing, and paying off debt.

3. Use the 50/30/20 Rule (or tweak it!)

| Category | % of Income | What It Covers |

|---|---|---|

| 🧾 Needs | 50% | Rent, groceries, utilities, insurance |

| 🎉 Wants | 30% | Dining out, shopping, streaming, fun |

| 💰 Savings | 20% | Investments, emergency fund, debt paydown |

You can adjust this to fit your goals. For example:

60/20/20 (more frugal), or 40/30/30 (aggressive saving)

4. Avoid Impulse Spending

Pause before you swipe.

The 24-Hour Rule:

Want to buy something that isn’t essential?

Wait 24 hours.

If you still want it, plan for it in next month’s budget.

This helps avoid emotional purchases and builds spending discipline.

5. Track It Weekly

Don’t wait until the end of the month. Use apps like:

- YNAB (You Need a Budget)

- Mint

- PocketGuard

- Or even a simple spreadsheet

Knowing your numbers is power.

🧠 Pro Tips:

- Lifestyle creep is sneaky. Every time your income goes up, don’t immediately increase your spending.

- Use windfalls (bonuses, tax refunds) to boost savings or pay off debt — not just lifestyle upgrades.

- Spend with intention. Budgeting isn’t about restriction; it’s about freedom.

- Calculate your total monthly take-home income.

- Budget 80% or less of that for essentials, fun, and lifestyle.

- Avoid impulse purchases—sleep on it for 24 hours.

Example: If you make $4,000/month, aim to keep total monthly spending under $3,200.

Pro Tip: Use the 50/30/20 rule: 50% needs, 30% wants, 20% savings.

3. Avoid Bad Debt

What it means: Debt isn’t always evil, but high-interest debt is.

How to do it:

- Pay off credit cards in full each month.

- Refinance or consolidate high-interest loans.

- Only borrow for appreciating assets (e.g., home, education with high ROI).

Example: A $2,000 balance on a 20% APR credit card costs $400+ a year just in interest. Pay it off ASAP.

4. Build an Emergency Fund

What it means: A financial cushion helps you avoid going into debt when life surprises you.

How to do it:

- Start with $1,000, then build up to 3–6 months of essential expenses.

- Keep it in a high-yield savings account—not your checking account.

Example: If your monthly needs total $2,500, aim for $7,500–$15,000 in emergency savings.

🔒 Bonus: Avoid touching it unless it’s a real emergency—like job loss or a medical bill.

5. Invest Early and Often

What it means: Time in the market beats timing the market.

How to do it:

- Open a retirement account (401(k), Roth IRA, etc.).

- Automate monthly contributions—even small ones matter.

- Stick to low-cost index funds or ETFs.

Example: Invest $200/month starting at 25, earning 8% yearly. By 65, you’ll have over $600,000.

6. Live Below Your Means

What it means: Don’t inflate your lifestyle as your income grows.

How to do it:

- Avoid unnecessary upgrades (car, phone, apartment) just because you “can afford it.”

- Create a list of financial goals before spending new income.

Example: Instead of upgrading to a $3,000/month apartment, stay in your $2,000/month place and invest the difference.

7. Track Every Dollar

What it means: Know where your money is going—every dollar should have a job.

How to do it:

- Use a budget tracker like YNAB, Mint, or a simple Excel sheet.

- Review weekly—make it a Sunday routine.

Example: Realize you’re spending $450/month on takeout? Cut back to $200 and save the rest.

8. Set Financial Goals

What it means: Having a target keeps you motivated and focused.

How to do it:

- Use SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound).

- Break large goals into mini milestones.

Example: Goal: Save $10,000 for a house down payment in 24 months → That’s $417/month.

🔒 Bonus tip: Print a tracker or use a visual savings goal chart.

9. Keep Learning About Money

What it means: Financial literacy is a superpower.

How to do it:

- Read one finance book every quarter.

- Listen to podcasts while commuting or working out.

- Follow financial creators or blogs you trust.

Example: Start with “The Psychology of Money” by Morgan Housel or “I Will Teach You To Be Rich” by Ramit Sethi.

10. Protect Your Assets

What it means: Insurance and legal protections are part of being financially secure.

How to do it:

- Have renters or homeowners insurance, even if optional.

- Get term life insurance if you have dependents.

- Make a will or use an online legal service to set one up.

Example: A $300 renters insurance policy could save you $15,000 in a fire. Worth it.

Remember – It’s Not About Perfection

Money management is a skill—not something you’re born with. These 10 rules aren’t about being perfect—they’re about building habits that make you feel in control and secure.

Start small. Pick two rules to focus on this month. Automate your savings. Track your expenses. Build that emergency fund.

And celebrate your wins along the way—because financial freedom isn’t about restriction. It’s about choice.